Angola´s economy should contract by more than 4% in 2020, making even harder the management of the country´s debt, already above 100% of GDP, and a default possible, according to the Economic Intelligence Unit´s (EIU) latest report on the country. With China among Angola´s main creditors, a bilateral deal is likely, but negotiations could prove difficult.

Angola’s public debt/GDP ratio reached 109% at end-2019, with more than 40% of total government revenue going towards servicing public external debt, the country’s single largest outgoing. The EIU expects the country’s public debt burden to increase over 2020. According to the report, more arrears are expected, and possibly even a full default.

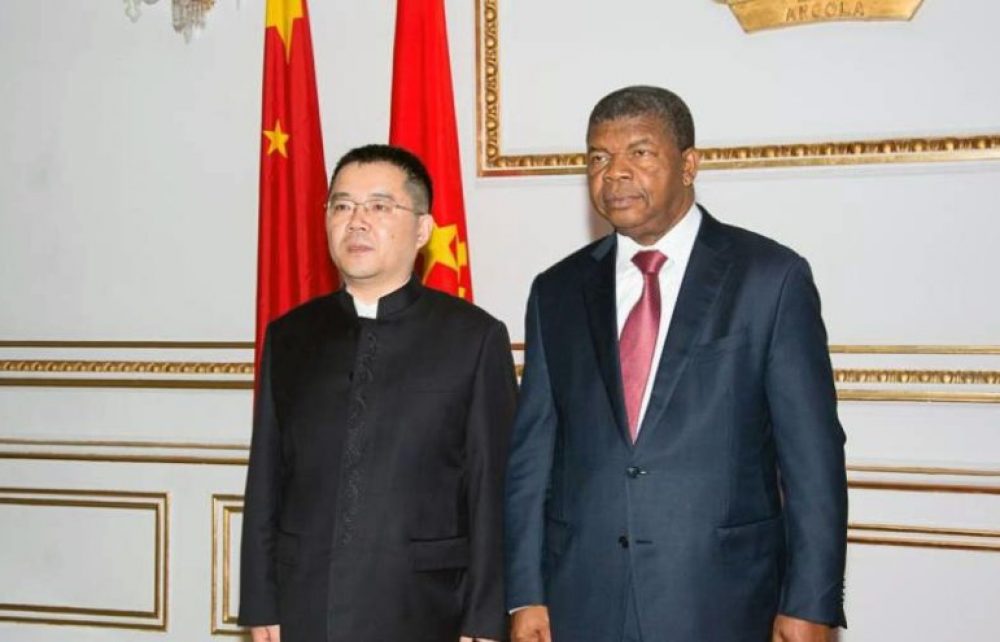

“A large portion of the country’s debt is owed to China, so a deal could be brokered bilaterally, but this could lead to repayment being linked to future oil revenue at a less favourable rate, a practice that Angola has previously said that it wants to stop”, adds the EIU.

The EIU projects that real GDP will contract by 4.1% this year but in 2021 real GDP will grow 0.1%. Inflation is expected to rise to 24% in 2020 (from 17.1% in 2019) an increase driven by a sharp depreciation of the kwanza due to steep decline in oil exports (and US dollar availability) and the introduction in October 2019 of VAT, initially at 14%, but says that that average inflation will decline to 10.4% in 2024.

“Angola’s economic prospects remain poor, with recession forecast to continue for a fifth year in 2020. In 2020 exports will decline sharply and low oil revenue will limit the ability of the government to ramp up spending significantly and provide social safety nets to protect incomes during the lockdown; tight credit conditions will constrain private consumption; and low oil price and global economic contraction will limit investment” the report says.

“Oil exports will continue to decline, while investment inflows will still be weak as oil prices remain low. In 2022-24 growth will average 4.3% a year, driven by resurgent growth in agriculture, mining, construction, manufacturing and services as monetary policy is loosened and as higher global oil prices support broader economic activity and investment inflows.” according to the EIU report.

Ongoing moves by the President João Lourenço´s government to attract investment and reduce cronyism have been encouraging, but the report considers that further efforts to tackle corruption, poor regulation and the crowding-out of private investment by the public sector “are necessary to generate significant gains in real GDP.”

The government’s emergency measures will not be sufficient to compensate for lost revenue and rising spending needs, and the EIU forecasts a large budget deficit for 2020, as well as an increased external debt stock to finance this deficit.

Angola´s oil output was estimated at 1.39m barrels/day (b/d) in 2019, below the OPEC-imposed cap of 1.48m b/d for the year and output volumes have declined in recent years, owing to maturing fields an a lack of investment.

The report by the Economist Intelligence Unit estimates that oil output will decline further in 2020, as Angola’s OPEC-mandated production quota is lowered to 1.18m b/d for May and June, rising to 1.25m b/d in the second half of the year.

“A major barrier to structural reform”, it adds, “has been the political elite’s stranglehold on the economy, which has resulted in a resistance to reform, a reduction in transparency and an increase in opportunities for rent-seeking.”