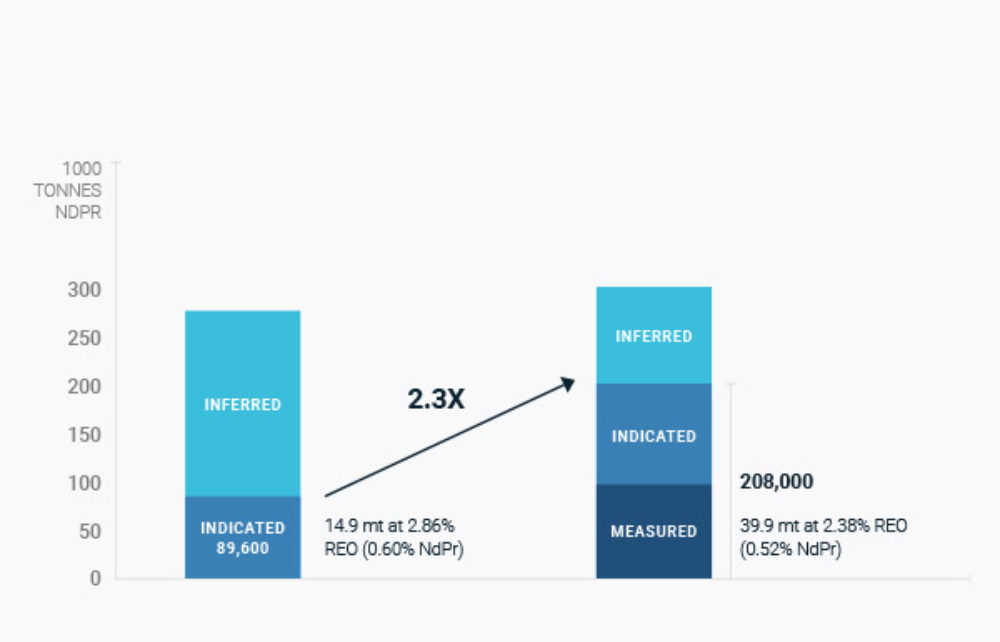

Rare earths reserves at the Longonjo site, in Angola, are 2.3 times larger than the estimate used in its Pre-Feasibility Study, according to mining company Pensana, which partners in the project with China Great Wall Industry Corporation (CGWIC).

“Respected industry specialist SRK Consulting has reported an upgraded Measured and Indicated estimate for Longonjo which is 2.3 times larger than the estimate used in last year’s Pre-Feasibility Study”, Pensana says in a statement released on Sunday.

Executive Director Dave Hammond said “this substantial upgrade will underpin the Bankable Feasibility Studies”.

“We expect it to lead to a significantly extended mine life beyond the nine years defined in last year’s Preliminary Feasibility Study”, Hammond added.

“In addition, we have only just begun to explore the fresh rock mineralisation which lies immediately beneath the weathered zone. We’ve tested it to 80 metres so far with several holes ending in mineralisation, with further drilling we are expecting to grow the resource estimate”, according to the Pensana executive.

“Longonjo looks very impressive when compared with the industry leaders Lynas and Mountain Pass. As every geologist knows it is difficult to make a direct comparison between resource estimates (…) Longonjo now looks very impressive indeed against the industry’s billion-dollar giants”, the company added.

Western powers have put them on lists of strategic minerals and are trying to develop their own supplies, but analysts say China’s dominance will be hard to shake.

Mining company Pensana announced this month it has entered into an agreement with China Great Wall Industry Corporation (CGWIC) for the financing, engineering, procurement and construction works for the Longonjo project in Angola.