The Covid-19 crisis has caught many African countries with high levels of debt, and therefore without fiscal room to face both the need to assist populations and service debt payments, while tax income is expected to fall due to the economic slowdown. The call is now growing from African Governments, with support from the United Nations and NGOs, for a debt relief package. Around one-fifth of Africa’s debt pile is estimated to be owed to China.

In a statement sent Sunday to the G20 governments, the International Monetary Fund and the World Bank, over 100 organisations call for immediate cancellation of debt payments by developing countries, in response to the Covid-19 health and economic crises, according to the Jubilee Debt Campaign. The canceling of debt payments in 2020 should be accompanied by “a process to reduce debt burdens to sustainable levels through overall debt cancellation in coming years”.

According to the statement, 69 of the poorest countries for which there is IMF and World Bank data, are due in 2020 to pay $19.5 billion to other governments and multilateral institutions, and $6 billion to external private lenders.

Signatories of the statement include the African Forum and Network on Debt and Development (Afrodad), Asian Peoples’ Movement on Debt and Development (APMDD), ActionAid International, The ONE Campaign, Cafod, Save the Children, Tearfund and Global Justice Now, as well as the Mozambique Budget Monitoring Forum, and other African NGOs.

While the the IMF and World Bank have called for a suspension of debt payments by the poorest countries to other governments, these payments would still need to be made in coming years. At a meeting last week, African Finance Ministers, called, on the other hand, for a suspension of all interest payments in 2020, and all principal and interest payments by fragile states.

The Jubilee Debt Campaign defends debt payments “need to be cancelled with immediate effect, including payments to private creditors”. “This is the fastest way to keep money in countries to use in responding to Covid-19, and to ensure public money is not wasted bailing out the profits of rich private speculators”.

The statement calls for multilateral institutions, including the IMF and World Bank, and lending governments, to offer an immediate cancellation of all debt payments for the remainder of 2020 for all countries in need, and most urgently for the poorest countries. Another request is that the IMF and World Bank urge any country ceasing multilateral and/or bilateral debt payments to also cancel payments to private external lenders.

The 100 signatories also request the G20 to support moves by any country to stop making payments on debt to private external lenders and “key jurisdictions, especially the UK and New York, to pass legislation to prevent any lender suing a government for stopping debt payments in 2020”. “Almost all international debt contracts are owed under UK or New York law”, it says.

Another request is the creation through the United Nations “of a systematic, comprehensive and enforceable process for sovereign debt restructurings”. The IMF, it adds, should introduce clear guidelines on when a debt is unsustainable, and follow its policy only to lend to countries with unsustainable debts if there is a default or debt restructuring.

In the Global Economic Outlook 2020 report, released in January, the World Bank estimates that the debt of governments in the sub-Saharan Africa region will reach 62% of Gross Domestic Product (GDP), on average, in 2020, 22 percentage points higher than the level recorded in 2011.

Among the countries with high debt burdens are Angola, Ghana, Mozambique, Namibia, South Africa and Zambia, and they are considered, “susceptible to sudden increases in risk aversion of the investor,” the report said.

“This could lead to a considerable exchange rate depreciation, capital outflows and increases in the costs of loans because the risk premiums increase dramatically. Where the debt is largely denominated in foreign currency, strong devaluations of the currency may make debt servicing more complicated,” said the World Bank.

African finance ministers agreed last week that the continent needs a stimulus package of $100 billion, including $44 billion in debt-servicing waivers, to face the Coronavirus crisis. The package is about 5% of a proposed U.S. stimulus for that country alone.

According to the final statement, the Ministers also suggested that if the crisis were to continue, an additional $50 billion may be needed for the building back process in 2021, including continued stay on interest payments.

The United Nations Economic Commission for Africa, which facilitated the ministerial meeting, is considering reviewing the region’s growth estimate for this year, which was already reduced to 1.8% from 3.2% earlier this month.

The african finance chiefs asked the European Central Bank, the International Monetary Fund and World Bank to join stimulus discussions. Nearly 80 governments have requested support from the IMF to battle the Covid-19 crisis.

In March, Ethiopian Prime Minister Abyi Ahmed called on international lenders to forgive African debt, and later received support from Senegalese President Macky Sall, South African President Cyril Ramaphosa and even major creditors including the World Bank and the IMF.

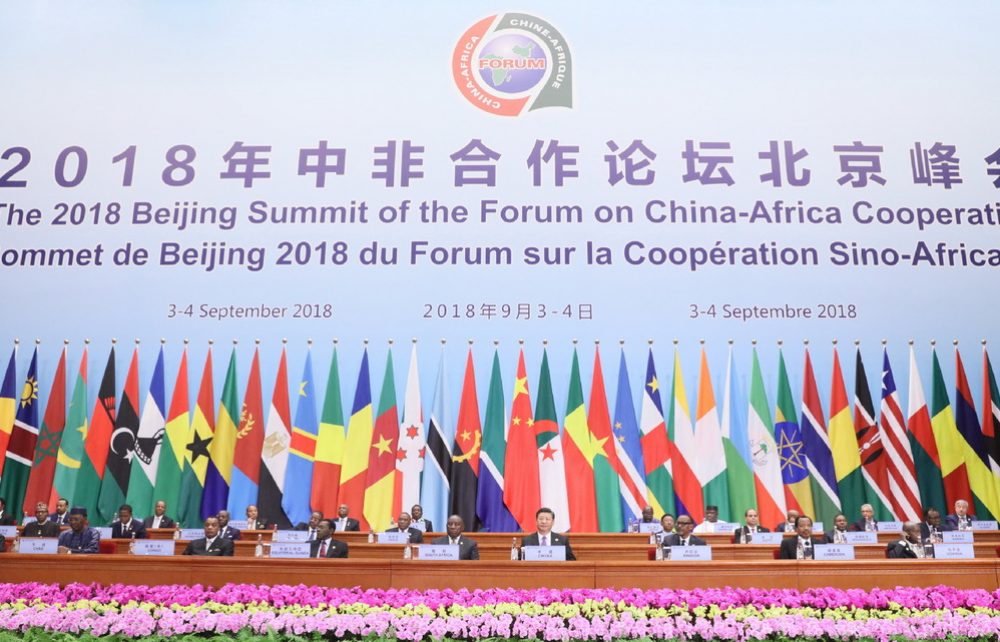

The China-Africa Research Initiative at Johns Hopkins University found that from 2000 to 2017 China lent African governments $143 billion. African governments also went to private capital markets over the last few years to borrow around $55 billion.

According to the China-Africa Project, China owns 20% of the debt in Africa and is the largest bilateral creditor in a number of the continent’s major economies, so it “plays a disproportionately important role in this discussion”.