The Belt and Road Initiative, China’s global infrastructure project, will have its investments in 2020 fall “well short” of last year’s level, due to financial strains in participating countries, according to Moody’s Investors Service.

In the first half of 2020, the value of Chinese-led new contracts and investments in BRI countries totaled USD 23.5 billion, suggesting that full-year volumes will fall short of last year’s USD 104.7 billion, the credit ratings agency says in a new report,

Such a decline is attributed to greater economic and financial pressure faced by participating countries, many of which are small economies with diminished abilities to take on new debt financing, said Michael Taylor, managing director and chief credit officer for Asia-Pacific at Moody’s.

“Quite a number of those are relatively small and they tend to have quite concentrated economies, whether it’s in commodities or tourism; some of them are also quite dependent on remittances — and each of those have been quite badly hit by coronavirus,” Taylor told CNBC’s “Squawk Box Asia” on Tuesday.

“So certainly, this year, we’ve seen a rise in credit stress that we don’t expect to go away in 2021,” he added.

The Moody’s report said some BRI participating countries have sought financing support from the International Monetary Fund or debt relief from G-20 lenders, including China. Those countries include Pakistan, Zambia, Tanzania and Angola, the agency noted.

Credit strains and project delays facing those countries could also cause financial losses at Chinese entities with large BRI exposures, according to the report.

Moody’s named China Development Bank and Export-Import Bank of China as having “significant exposure” to projects under the initiative.

But overall damage, if any, will likely be manageable for the banks and other Chinese companies involved, said the agency.

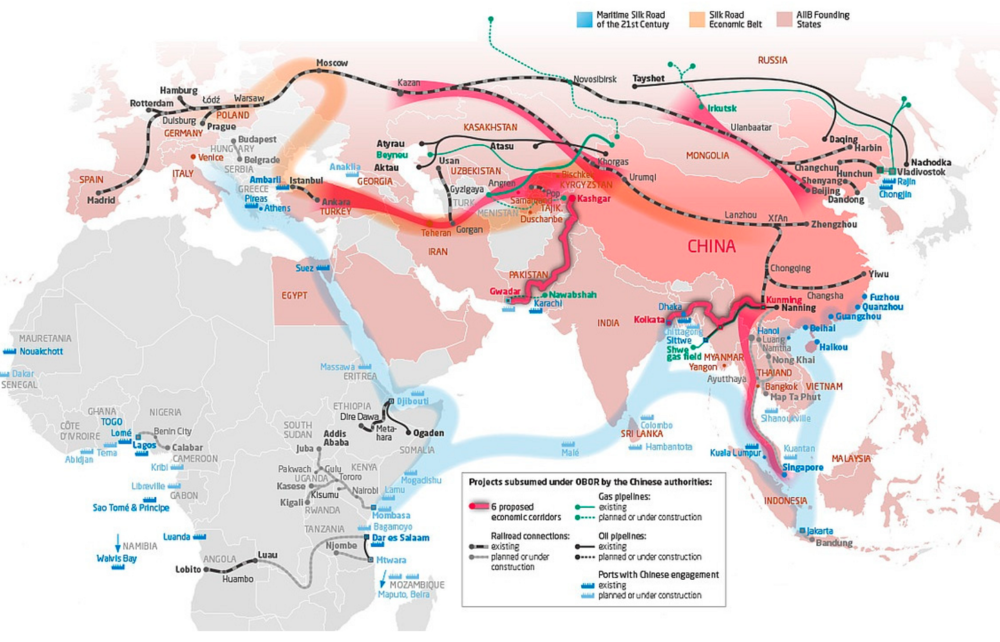

The Belt and Road Initiative is an ambitious Chinese policy that started out focusing on building infrastructure networks connecting China to central Asia, Europe and Africa.

The pandemic’s impact on the Belt and Road Initiative is likely to persist for years. Moody’s estimated that fresh Chinese-led investment flows into participating countries may not return to levels seen in 2014-2019 in the next two years.

Still, Beijing wouldn’t “reverse course” on its BRI strategy “given the considerable financial outlay and political capital that the country has invested in the initiative,” the agency said.

The BRI is already becoming “increasingly green,” Moody’s said in its report. Renewable energy accounted for around 58% of new contract values in the first half of 2020 — climbing from 18.5% in 2014, the agency said.